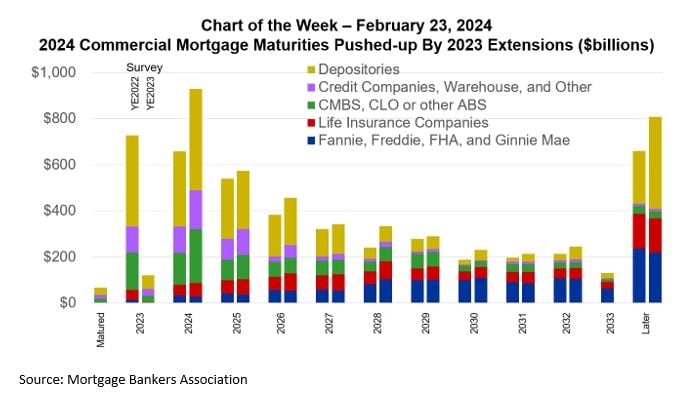

Chart of the Week: 2024 Commercial Mortgage Maturities Pushed Up by 2023 Extensions

Commercial mortgages tend to be relatively long-lived, spreading maturities out over several years.

A lack of transactions and other activity last year, coupled with built-in extension options and lender and servicer flexibility, has meant that many commercial mortgages that were set to mature in 2023 have been extended or otherwise modified and will now mature in 2024, 2026, 2028 or in other coming years. As a result, the amount of commercial mortgage debt maturing this year rose from $659 billion as of the end of 2022 to $929 billion as of the end of 2023.

MBA’s latest report on commercial mortgage maturity volumes showed that maturities vary significantly by investor and property type. Just $28 billion (3 percent) of the outstanding balance of multifamily and health care mortgages held or guaranteed by Fannie Mae, Freddie Mac, FHA and Ginnie Mae will mature in 2024. Life insurance companies will see $59 billion (8 percent) of their outstanding mortgage balances mature in 2024. By contrast, $441 billion (25 percent) of the outstanding balance of mortgages held by depositories, $234 billion (31 percent) in CMBS, CLOs or other ABS and $168 billion (36 percent) of the mortgages held by credit companies, in warehouse or by other lenders will mature in 2024.

By property type, 12 percent of mortgages backed by multifamily properties will mature in 2024, as will 17 percent of those backed by retail and 18 percent for healthcare properties. Among loans backed by office properties, 25 percent will come due in 2024, as will 27 percent of industrial loans and 38 percent of hotel/motel loans.

The total $4.7 trillion of commercial mortgage debt outstanding is spread over a wide range of property types, capital sources, metro areas, submarkets, vintages, borrowers, and more. And, as designed, as a loan matures, owners -- sometimes with lenders and servicers -- will work through that deal’s particulars to determine how best to move it forward. No two deals are the same and, particularly now, broad brushstrokes about the CRE markets don’t apply.